How Do Lenders Look at Your Credit?

Summary

Understanding the ways lenders view your credit can be confusing. Learn what a credit lender might be looking for when you apply for a loan.

In this article:

If you're in the market for a new loan or credit card, it's important to first answer two questions: “How does a lender use a credit report?” and “What do lenders want to know about you?”

Knowing the facts about what’s important to lenders is the first step to getting the best rate on a loan. We’re here to lend you some tips on what lenders look for before you borrow money.

What are the 5 C’s of credit?

Even if you understand what your credit score tells lenders about you, there’s more to the story. Each lending situation is a bit different, but the 5 C's of Credit is a handy list that helps outline what lenders really care about:

Character. Lenders need to see you are a responsible borrower, so they might look at how long you’ve been at your job, debt repayment history and other credentials.

Capacity. This is your ability to make your monthly payments with the money you earn. If your income won't cover your payments, lenders might consider you a high-risk borrower.

Collateral. A loan secured with collateral may have a lower interest rate and a higher borrowing limit than an unsecured loan, since it’s less risky for the lender.

Capital. In the world of lending, your capital is a down payment, which shows you’re really committing to the lending agreement by investing money in it up front.

Conditions. Lenders look at why you’re taking the loan, current interest rates and the amount you’re looking to finance. Also, lenders may consider conditions that are outside of the borrower's control, such as the state of the economy, industry trends or pending legislative changes.1

What do lenders look for on your credit report?

When lenders pull your credit report from the 3 major credit bureaus — Equifax®, Experian® and TransUnion® — they see much more than just where you fall on the credit score scale.

Here’s some of what lenders see on your credit report:

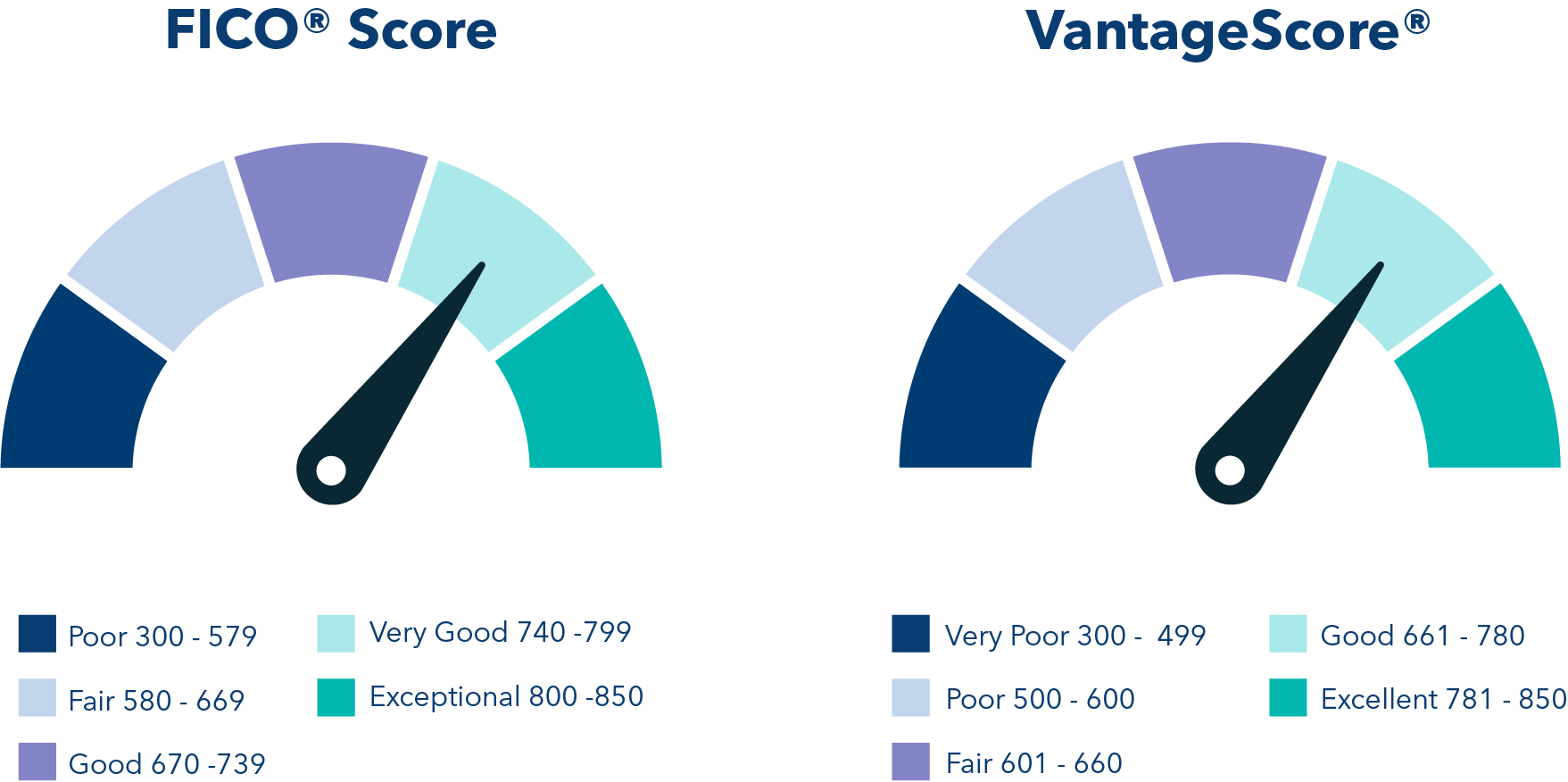

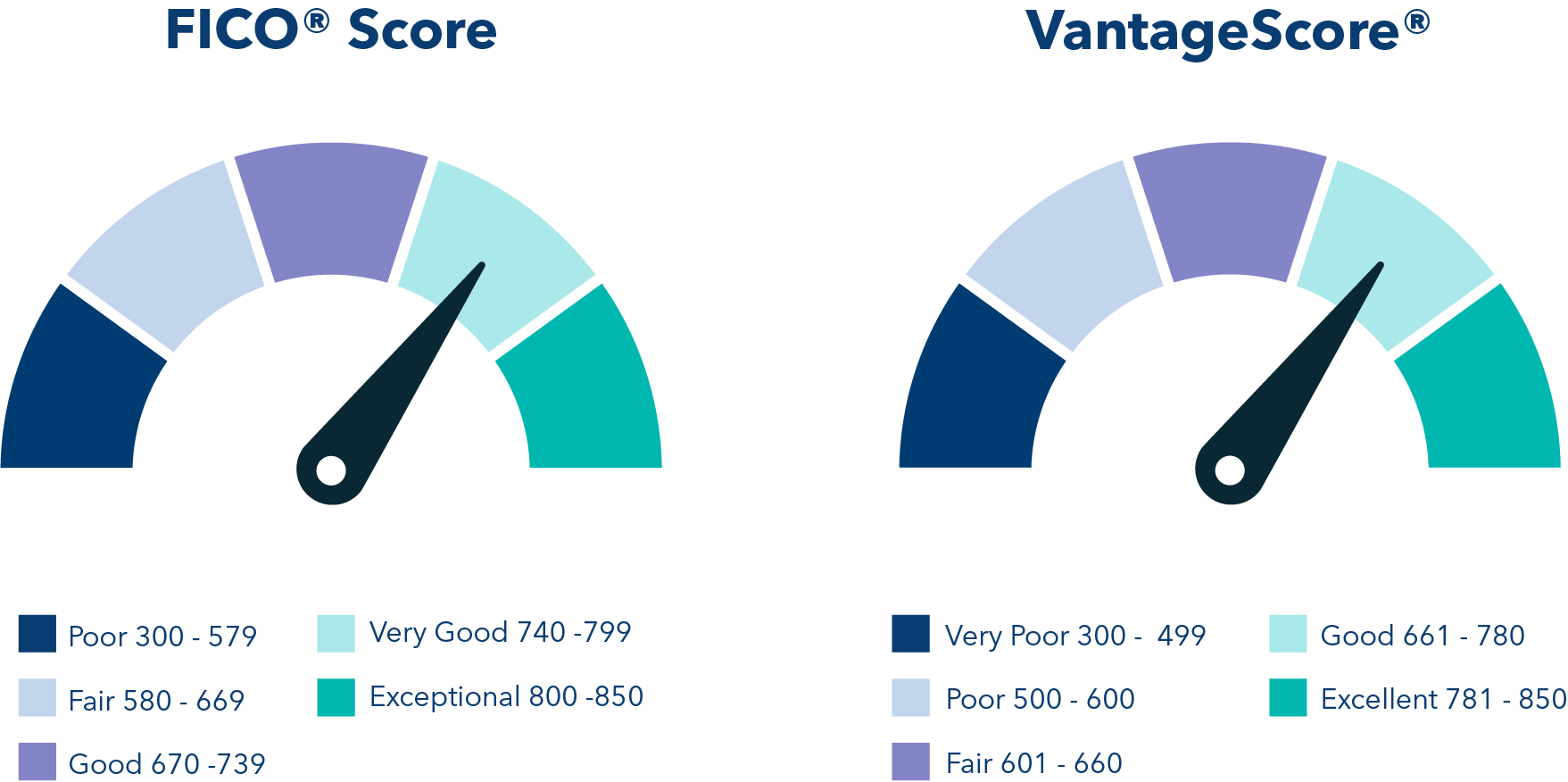

Credit scores. Think of your credit score as a financial report card. Your three-digit credit score is grouped into categories — they may differ slightly between the two main credit calculators (FICO® credit score and VantageScore®)2, but they generally fall into the following ranges:

Getting a free copy of your VantageScore credit score is easy for OneMain customers. Log in to your account online or on our app, and you will see your score displayed on your online account summary page. Or, if you don’t have an online account, you can sign up on our website!

Account history and what types of credit you have.

The easiest way to define credit history is how long you've had credit and how well you've handled it. Lenders also look for a consistent history of paying your bills on time. A pattern of late or missed payments makes it seem like you have trouble repaying debt, so they may see you as a risk. While some may still offer you a loan or credit card, your interest rate could be higher than a person with a better credit history.

Also, lenders want to know that you can handle different types of credit, such as mortgages, car loans, credit cards and personal loans. This shows you can be responsible with many forms of credit.Available credit vs. how much you’re using. (Also known as credit utilization ratio.)

Lenders also like to see that you haven’t used up all of your available credit so you have the least amount of debt possible. For example, if you have a $5,000 credit limit on your credit cards, it may raise concerns with lenders if you're already using $4,000. A good rule of thumb is to keep your credit utilization at 30% or less.3Current monthly income vs. monthly expenses. Also known as DTI, your debt-to-income ratio tells lenders you have enough income to pay your debts. This is why lenders request your income along with mortgage or rent, car payments and other monthly bills. They want to see that even after paying all your bills, you’ll still have enough money to pay them as well. The lower your DTI the better. You can calculate your own DTI here.

If you pay your bills on time. Lenders want to know you pay your bills on time. They also want to know if you have any accounts in collection or if you’ve declared bankruptcy. There’s a reason payment history is a whopping 35% of your FICO score.4 The more responsible you are with lenders' credit you already have, the more likely you are to be responsible with a new account.

Number of recent credit applications. Certain lenders see applying for several new credit cards at once as a sign that you may be in financial trouble. However, some lenders know that multiple applications for a car loan within a short period of time means you’re shopping for the best rate, not buying multiple cars. As long as the inquiries were all made within a certain period of time (usually 14 days) most credit scoring models count them as one.5 Some inquiries don’t count against your score, either. (More on that later!)

Available collateral. If a lender will allow you to pledge property you own as security for repayment of the loan, this is known as a secured loan. Remember that if you use collateral to get a secured loan, the lender can take possession of your collateral, sell it, and apply the sale proceeds to your outstanding loan if you don’t make your required loan payments.

How to manage your credit report for applying to lenders

No matter what type of credit score you have, it’s important to keep track of your credit report so you can get approved and get the best rates. Some lenders, like OneMain, don't have a minimum credit score requirement. As mandated by the federal government, every U.S. citizen is entitled to one free credit report from each of the 3 credit bureaus each year.6 Through April 2022, you can get free weekly credit reports to help you through the COVID-19 pandemic. It’s a great way to prevent unwelcome surprises and work your way to excellent credit.

Can I check for credit offers without affecting my credit?

Whenever you apply for a loan, credit card or line of credit, the issuing lender normally checks your credit by conducting a “hard pull” on your credit report, which can decrease your credit score. Although hard credit inquiries stay on your credit report for about two years, their significance decreases with time.7

Some lenders may give you a chance to prequalify for a loan or credit card without knocking points off your credit score. Some lenders even show you credit limits, interest rates and other important information in the prequalification process. Remember that if you decide to accept the offer, it will probably show up as an official inquiry on your credit report, which affects your credit score.

Is there anything else lenders look for in your application?

The financial industry’s credit standards can sometimes feel like a harsh way of deciding who’s worthy enough for a loan, especially if your credit score could use improvement. Lenders usually want to see 12-18 months of positive credit history, as well as evidence that you have the means to pay back what you finance.

Do lenders always accept applications for credit if borrowers meet the criteria in this article? Generally yes — if they offer the kind of credit you're seeking in your state. But it’s most important to remember that lenders want to know you're going to pay them back. If you feel confident about your credit — great job and keep it up! If not, try these tips to get smart about credit and manage your credit score.

1. https://www.investopedia.com/terms/f/five-c-credit.asp

2. https://www.creditkarma.com/advice/i/credit-score-ranges/

3. https://www.thebalance.com/what-is-a-good-credit-utilization-ratio-960548

4. https://creditcards.usnews.com/articles/what-is-considered-a-good-credit-score

5. https://www.experian.com/blogs/ask-experian/do-multiple-loan-inquiries-affect-your-credit-score/

6. https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act

7. https://www.experian.com/blogs/ask-experian/credit-education/report-basics/hard-vs-soft-inquiries-on-your-credit-report/

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.