4 Important College Costs to Consider

Summary

The total price of college includes more than just tuition and fees. Here are four important college costs to consider.

In this article:

*OneMain does not make student loans

When searching for one’s ideal college or university, cost is often a significant factor. In some cases, it may impact a student’s choice of which school to attend.

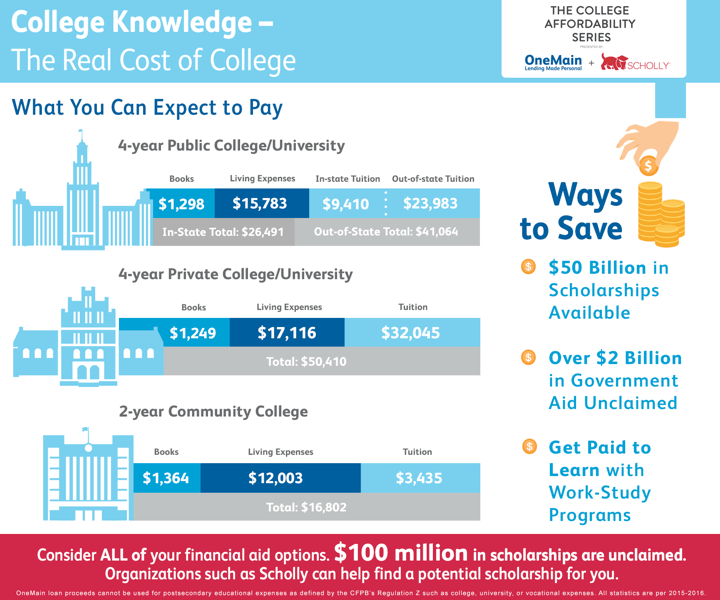

To get an idea of the cost of college, check out the following infographic we created with our content partner, Scholly:

Sources: BigFuture (1), BigFuture (2), Federal Student Aid

Understanding the details of college costs could help students and parents create a financial plan for the road ahead.

Here is some more information on four important college costs to consider:

1. Tuition & fees

When it comes to college costs, tuition is typically one of the largest expenses. Area of study, the amount of credit hours and type of school can all factor into the final cost of tuition1. And as the infographic states, the cost difference between in-state and out-of-state tuition can vary significantly.

A student's chosen major can also affect the cost of tuition. Enrolling in the sciences and fine arts will typically cost more than other majors2. For instance, an engineering student at University of Illinois Urbana-Champaign paid nearly $5,000 more in tuition during the 2016-2017 school year than students in other majors2.

Fees can vary per student as well, depending on the school. To better understand what fees could apply, here are some examples:

- Registration fees

- Student services fees

- Student organization fees

- Endowment fees

Scholarships and grants can offer financial relief for eligible students. In addition to Scholly, a scholarship matching platform, there are several sources for obtaining federal grants. For more information on eligibility and how to apply, reference the websites for Federal Student Aid and the U.S. Department of Education.

2. Living expenses

A recent study by The College Board showed that over 50% of a college student’s budget can be spent on housing. There are a variety of factors that influence housing costs and the difference in price can vary significantly.

For example, a student attending Purdue University in West Lafayette, IN could save nearly 70% on housing costs by living off-campus3. However, a student attending Stanford University in Palo Alto, CA would pay 50% more in housing costs if they lived off-campus3.

Although housing will likely be the largest college living expense, there are others to be aware of and prepare for. Here are some other living expenses to keep in mind:

- Utilities (electricity, gas, internet)

- Food

- Toiletries

3. Books & supplies

According to the U.S. Public Interest Research Group, the average college student can expect to pay over $1,200 a year for books and supplies4. Although this total represents common supplies such as course materials and calculators, it does not include the cost of a laptop and other items.

Fortunately, there are ways for students to lessen the impact of these costs. Here are a few suggestions to help lower the cost of books and supplies:

- Online search tools - Websites like BookFinder.com allow you to type in different search queries including author and book title to find used books for sale. Once you find the book you need, you can compare prices and choose from several different online marketplaces.

- Split the cost with a friend or classmate - If you know someone enrolled in the same class as you, see if they’re interested in splitting the cost of the book. It may be useful to create a schedule of when each person has the book so you can both accomplish your studying goals.

- Rent your books - Renting can be a good way to save on book costs. If you go this route, just make sure the version or edition you’re renting is the correct one for the course. Also, keep in mind that you may incur fees if the book is not returned in the same condition in which it was received.

- Buy used supplies - Gently used or refurbished items can be bought at discounted rates. If you’re looking to save money on school supplies, try searching for used supplies online or in local thrift stores.

4. Additional expenses

College life outside of the classroom will cost money as well. Whether creating a financial plan for a semester or an entire college career, it’s important to plan for all costs associated with being a student.

Creating a budget for additional expenses could lessen the impact on your overall finances. For tips on how to get started and stay on track, check out our blogs on building a budget and sticking to a budget.

The needs per student may differ but here are some potential additional expenses for college students to be aware of:

- Clothing & laundry

- Transportation

- Entertainment

- Extracurricular activities

Research and prepare

When considering the costs of college, it’s helpful to gather all the facts. Every student may have their own unique situation but understanding how to plan effectively for college costs can be useful today and in the future. Good luck!

1. https://bigfuture.collegeboard.org/pay-for-college/college-costs/quick-guide-college-costs

2. http://www.collegedata.com/cs/content/content\_payarticle\_tmpl.jht

3. http://www.businessinsider.com/cost-of-off-campus-housing-in-college-2015-9

4. ttp://www.usnews.com/news/articles/2014/01/28/report-high-textbook-prices-have-college-students-struggling?

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.