Hear Ye! Money Lessons You Can Learn from Past Presidents

Summary

Say! You there. Come learn a few personal finance lessons from mistakes of past presidents.

In this article:

President’s Day is a great time to recognize the legendary accomplishments of past presidents. Today, however, we’re going to learn some money lessons based on their financial mistakes.

Cut down on food costs

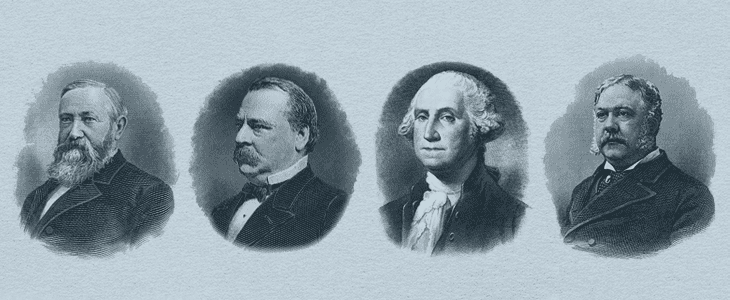

If George Washington really cut down that tree, he could’ve saved his family money on food by taking those cherries home.

Whether you’re feeding yourself or an entire family, here are some tips to lower your grocery bill:

- Make a list - This tried-and-true method has been around for decades. To keep your list up-to-date, leave a pen and pad in the kitchen to jot down what needs replacing.

- Utilize coupons - In addition to clipping store coupons found in newspapers and weekly mailers, be sure to look for manufacturer coupons online as well. Websites like coupons.com offer printable coupons for dozens of stores and products.

- Join loyalty programs - As stores compete for business, many of them offer loyalty programs to attract and retain customers. If you regularly shop at certain stores, it’s definitely worth your while to take advantage of these programs.

Stop overspending

Chester A. Arthur reportedly owned 80 pairs of pants and changed outfits multiple times a day. It’s also said that he hired a valet whose only job was to watch after his clothes and personal belongings.

If you also have the urge to splurge, consider these tips to help prevent overspending:

- Use a shopping app - Some people don’t go anywhere without their phone, including the mall and grocery store. If you prefer technology to a pen and paper, check out the shopping apps at Google Play and the Apple App Store.

- Check comparison sites - Websites like Bizrate allow you to instantly compare prices from several retailers. You can also set price alerts on some websites that will notify you when the price of an item drops.

- Give yourself a cash allowance - At the beginning of each month, place cash into envelopes and label them with categories like “gifts” and “going out.” Knowing that the cash will eventually run out could help you think harder about each purchase.

Reduce electric bill

Benjamin Harrison, the first president to have electricity in the White House, was rumored to sleep with the lights on. Imagine that electric bill.

If you’re looking for ways to trim your utility bills, these might spark some ideas:

- Unplug certain electronics when not in use - Energy Star reported that the average U.S. household spends $100 per year to power devices when they’re off or in standby mode.1 Identify which devices can be turned off when not in use and pull the plug.

- Use power strips - Plug electronics that you use regularly into one smart power strip. They can help reduce the electricity wasted when these devices are idle without having to change your habits.2

- Replace incandescent bulbs with CFL or LED bulbs - If you still use incandescent bulbs in your home, you may want to consider switching to Compact Fluorescent (CFL) bulbs or Light Emitting Diode (LED) bulbs. In addition to cutting your energy costs, you may also be able to reduce your lighting costs.

Balance your budget

Legend has it that Thomas Jefferson routinely logged his earnings and expenditures. However, he allegedly spent too much, never balanced his books and spent his final years deep in debt.

If you need help balancing your personal budget, this advice could help:

- Make it realistic - Create a budget that is achievable but still makes a positive impact on your finances. Don’t set yourself up to fail.

- Track every penny you spend - This may sound basic, but it can be a real eye-opener. Tracking every expenditure will force you to look at where your money is going.

- Cut bad habits - Cutting bad habits can be equally difficult and rewarding. Try to identify your most costly habits in the beginning and go from there.

Well said, old chap!

Learning from the mistakes of others can be helpful in life. This President’s Day, use these lessons to take leadership of your finances.

- ENERGY STAR. “ENERGY STAR @ home tips." Energystar.gov.

https://www.energystar.gov/products/energy_star_home_tips (accessed February 2, 2018).

- Earle, Lieko and Sparn, Bethany. “Choose the Right Advanced Power Strip for You.” Energy.gov. https://energy.gov/energysaver/articles/choose-right-advanced-power-strip-you (accessed February 6, 2018).

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.