What is a Personal Check vs. a Business Check?

Summary

Looking for the difference between business vs. personal checks? Learn the purposes for each and see why a personal check is helpful for transactions.

In this article:

No matter how blended the personal and professional can be, it shouldn’t extend to finances. So, even if your business is personal, your checks shouldn’t be. Business and personal checking accounts typically have different features tailored to their purposes. The same goes for business and personal checks. While these two types of checking accounts both allow you to make purchases, where the money comes from and how it’s recorded can have a big impact on your life and business.

What is a business check?

Business checks pull money from a business checking account rather than a personal checking account. It’s the paycheck you receive from your employer or the checks you issue to your employees, among other business expenses. A business checking account is a best practice for most businesses, including sole partnerships, corporations and Limited Liability Companies (LLC).

Keeping separate accounts for your business and personal transactions creates clear financial boundaries that will make accounting, taxes and investing in your business easier. If you apply for a business loan, for example, you’ll need to provide financial information based on an established business account. Dedicated accounts for your personal and work lives, even for very small businesses, may seem like an added complication but could actually save you time, money and stress.

Types of business checks

Types of business checks vary based on their purpose and design. Common varieties include payroll checks, used to compensate employees, and vendor checks, issued to suppliers for goods or services rendered. Another type is the cashier's check, which is available to businesses and individuals, and is used for large transactions where guaranteed funds are required.

What is a personal check?

Personal checks pull money from a personal checking account that you use for normal, non-business expenses. It’s the large rent check you write every month or the $10 check you get in a birthday card. Personal checks are printed with an individual’s name and can be written to other individuals as well as businesses to pay for anything from groceries to doctor’s bills..

Main differences between business and personal checks

While these types of paper checks look slightly different, they’re distinguished mainly by how and why you use them. Here are some basic characteristics of business checks versus personal checks:

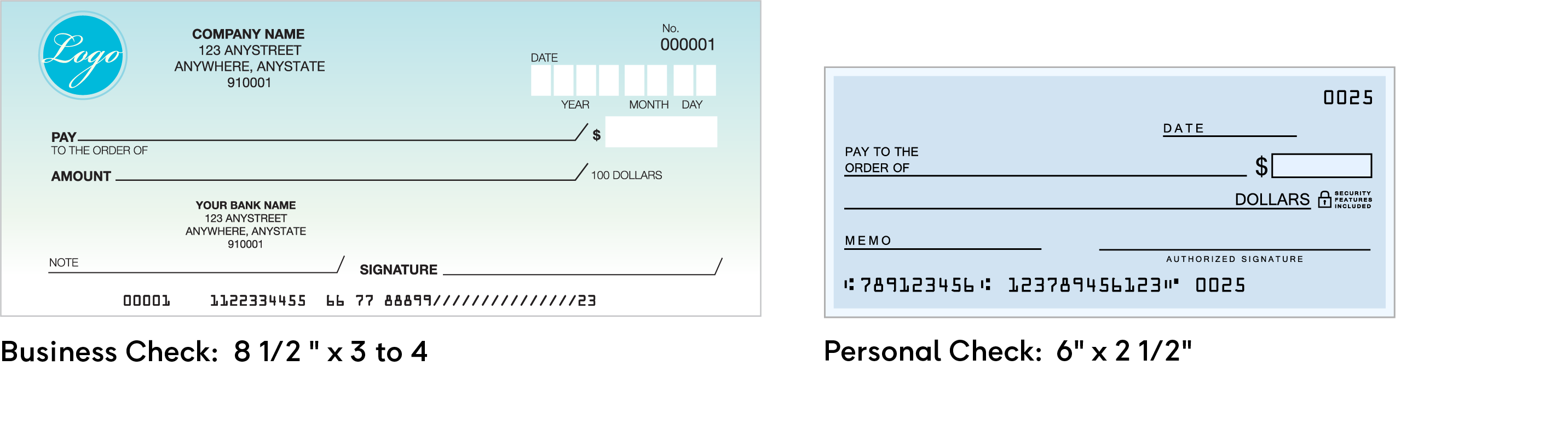

Physical appearance

The dimensions of a business check are larger than those of a personal check. The increased size of a business check allows for a logo and more space in the memo, payee, signature and additional information sections.1 Printing business checks can be easier because of their size, though handwritten checks are just as legitimate.

Cost

The cost of your supply of paper business checks is generally a little more than personal checks when you order them through your bank. However, you can shop around for lower prices at online check printers or even stores like Costco.

Fees

There are several fees associated with maintaining personal checks and business checks, including:

- Check printing fees

- Potential overdraft fees

- Stop payment fees

- Insufficient funds fees

- Transaction fees

Business checks may also have extra fees like customization fees for logos and branding and security features like watermarks and special inks.

Security

Business checks may have more security features than personal checks, like holograms, watermarks, special ink and even chemically sensitive paper. Personal checks have some security features but generally fewer.1

Cashing

You can cash a business check or a personal check at your bank, the bank that issued the check, whether you have an account or not, or with a check-cashing service. Since business checks may be written for higher amounts than personal checks, the bank may place a longer hold to verify funds to ensure the check is not returned.2 Keep in mind that “cashing” is different than “depositing” a check.

A check can become “stale” when it hasn’t been cashed or deposited within a certain timeframe, typically around six months from the date it was issued. After this period, banks may refuse to honor the check due to potential issues like insufficient funds or changes in the payer’s account status, requiring the issuer to reissue a new check.4

When do you need to use a business check?

Use business checks for business-related expenses. Even if you’re a sole proprietor, there shouldn’t be much gray area between personal expenses and business expenses. As business owners can attest, the list can feel endless, but here are some potential business expenses:

- Payroll (including yourself)

- Marketing

- Insurance

- Supplies

- Rent

- Utilities

- Equipment

- Software

- Loan payments

- Travel

When do you need to use a personal check?

The term “personal check” just means a check issued from your personal bank account. Personal checks can be used for most purchases you’d use a personal debit or credit card for. That includes most of life’s day-to-day expenses as well as large purchases like vacations, cars or homes.

Can you use business checks for personal use?

Using business checks for personal expenses is not recommended because it can make tracking spending difficult, complicate taxes and lead to potential legal and audit issues. Here’s a few reasons to keep your personal and business finances separate:

Taxes

Taxes can be frustrating even if you’re an exceptional bookkeeper. Sifting through all your personal and business purchases and expenses at the end of the year will cost you time and maybe money if you do not clearly account for all your finances.

Protection

Keeping your business and personal expenses separate creates a clear boundary between your personal assets and your business assets. If you have a business structure like a partnership, limited liability company (LLC) or corporation, your personal assets like your home, savings accounts or car will not be affected if your business faces legal issues.3

Credibility

Business checks make your business look more professional and put together. When an employee, investor or service-provider receives a personal check, they may question the health and legitimacy of your business.

Check out your options

When it comes to managing your business and personal expenses, remember that you have options. There are plenty of resources, services and software out there to help you manage every detail of your finances, down to the check design. Happy checking!

1. "How are Business Checks Different than Personal Checks." https://www.techchecks.net/resources/how-are-business-checks-different-than-personal-checks. Accessed 23 Sep. 2022.

2. "Business Check vs. Personal Check - First Republic Bank." 22 Jun. 2022, https://www.firstrepublic.com/insights-education/business-vs-personal-checks. Accessed 23 Sep. 2022.

3. “Why and How to Keep Your Personal and Business Finances Separate” https://www.bankofamerica.com/smallbusiness/resources/post/why-and-how-to-keep-your-personal-and-business-finances-separate/ Accessed April 2024

4. “Cashing Old Checks: How Long is a Check Good for?” https://www.bankrate.com/banking/checking/how-long-is-a-check-good-for/

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.