What is Debt-to-Income Ratio?

Summary

Debt-to-income ratio is the percentage of your gross monthly income you use for debt payments, a key factor lenders consider when you apply for a loan.

In this article:

While most people are familiar with the concept of loans (and taking out a loan), many know less about how lenders make loan decisions and what you might need to qualify for a loan. One factor lenders may use to determine your ability to repay loans is called your debt-to-income (DTI) ratio, a number that compares your monthly debt payments to your gross monthly income — the amount you earn each month before taxes and other deductions are taken out. To improve your chances of getting a loan approved, it’s important to understand how your DTI ratio is calculated, why it matters and how to optimize it.

How are DTI ratios used?

Your DTI ratio shows how much of your income is already committed to paying off debts, like your mortgage, loans and credit card bills. Lenders may use your DTI ratio to help them assess your ability to repay a new loan or line of credit. If a big portion of your income is already tied up repaying debts, lenders might be less likely to approve you for new credit.

How to calculate DTI ratio

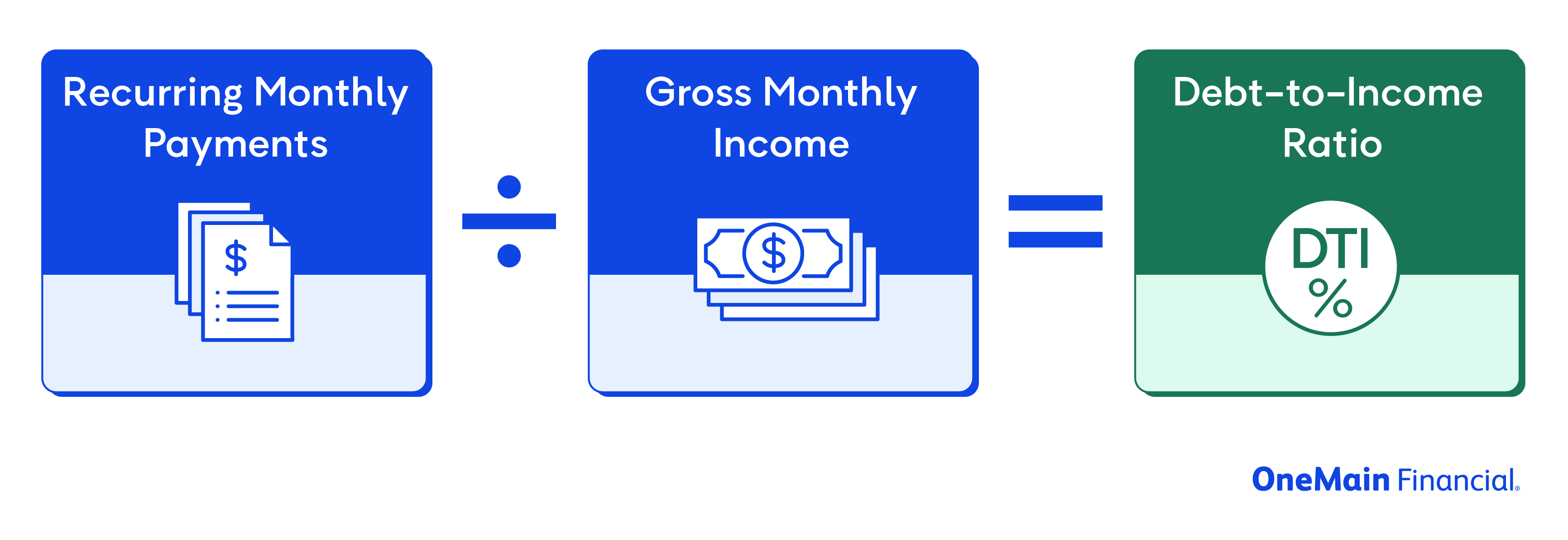

First, a little math. Begin by adding up all your recurring monthly debts. In general, any time you’re repaying money you’ve borrowed, it’s considered debt. The debt in your DTI ratio generally includes:

- Minimum credit card payments

- Housing costs

- Auto loan payments

- Personal loan payments

- Student loan payments

- Alimony or child support payments1

Divide the sum of your monthly recurring debts by your gross monthly income, which is the amount you earn each month before taxes and other deductions.

Let’s say your monthly debts total $1,000, and your gross monthly income is $4,000. $1,000 ÷ $4,000 = 0.25. This means that your DTI ratio is 25%.

What is a good DTI ratio?

In general, the lower your DTI ratio, the better, because it demonstrates you have available funds to pay back your debts. Lenders typically prefer a DTI ratio of 36% or lower, meaning that no more than 36% of your gross monthly income is going toward your debt payments.2 A DTI ratio of 43% is typically the highest you can have to still qualify for a mortgage.3 Keeping your DTI ratio low not only improves your chances of qualifying for a loan, but it also helps you maintain financial flexibility.

Why your DTI ratio is important

Lenders consider your DTI ratio when evaluating your application for a loan or line of credit. A lower DTI ratio may make it easier to qualify for a loan that works for your needs. For instance, you might be more likely to be approved for a lower interest rate or a higher borrowing amount.

How to improve your DTI ratio

If your DTI ratio is high, here are some steps you can take to improve it.

Reduce your monthly expenses

Reducing your monthly expenses could free up funds to focus on paying down debt, but that may mean cutting back on nonessentials in the short term to set you up for your long-term financial goals.

Creating and maintaining a budget can help highlight areas where you can cut costs — for example, if you notice you’re paying for a streaming service you no longer use, you might consider canceling it. Whenever possible, avoid taking on more debt by opting to pay with cash over a credit card. Using a budget calculator is a great way to see exactly where your money is going and keep yourself on track with your spending.

Increase your gross monthly income

Often easier said than done (but a goal for most of us), earning more money each month could directly and positively affect your DTI ratio.

Here are a few ways you could increase your income:

- Take a side job. Consider part-time work, freelancing or gig economy opportunities like driving for ride-share services or delivering food.

- Ask for a raise. If you’re performing well at your current job, consider negotiating a raise with your employer. Of course, a raise is not guaranteed, but it doesn’t hurt to ask or find out what you need to do to earn more in the future.

- Consider working overtime. If your job offers overtime pay, working additional hours could boost your income.

- Rent out property or space. If you have extra space in your home or an additional property, consider renting it out to make extra income.

Pay down debt

You can also work toward lowering your DTI ratio by tackling debt in a few different ways, whether that’s by consolidating multiple balances or paying them one at a time.

Consolidate debt

Applying for a debt consolidation loan from a lender like OneMain allows you to turn multiple monthly payments into a single, predictable monthly payment with a potentially lower interest rate and a set payoff date. Knowing how much you’ll owe every month — and when you’ll be done paying off your debt — may make it easier to stick to your monthly budget.

Just taking out a debt consolidation loan won’t lower your DTI ratio — you’ll still need to repay what you owe to the new lender. But a longer term and one fixed monthly payment may make your payments more manageable, helping you decrease your DTI ratio over time. Keep in mind that opting for lower monthly payments over a longer term could mean you’ll pay more in interest over time.4

Complete a balance transfer

You could also consider completing a balance transfer with a new or existing credit card to consolidate your credit card debt. A balance transfer allows you to move your debt to another card with a potentially lower interest rate, leaving you money to pay off balances more aggressively.

Unlike a loan, whose balance steadily reduces as you pay it off, a credit card balance only reduces if you don’t use it for new purchases and continue to make monthly payments. When you transfer a balance to a credit card, it’s a good idea to avoid making new charges, which would increase your DTI ratio.

Pay off balances one at a time

Consider one of two common repayment methods to work toward becoming debt-free: the debt snowball or the debt avalanche.

The debt avalanche method involves paying off the debt with the highest interest rate first and moving on to the next.

The debt snowball method involves paying off your debts from the smallest to largest, no matter how much the interest rate is.

Regardless of which strategy you choose, you’ll need to continue to make at least the minimum monthly payment on your other debts.

Accelerate your financial goals by managing your DTI ratio

By understanding and managing your DTI ratio, you’ll be better prepared for whatever financial goals you set your sights on, like buying your first home or saving for a new car. You’ll gain greater control over your finances, giving you a better chance to qualify for loans and take on new financial opportunities. Remember to regularly check your DTI ratio to track the progress you’ve made.

1 https://www.experian.com/blogs/ask-experian/how-to-calculate-your-debt-to-income-ratio/

2,3 https://www.investopedia.com/terms/d/dti.asp

4 https://www.bankrate.com/personal-finance/debt/pros-and-cons-of-debt-consolidation/#benefits

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.