How Daily Simple Interest Works

Summary

Interest on daily simple interest loan is calculated by using the daily simple interest method. Learn about the calculation and how this loan works.

In this article:

[dey-lee sim-puhl in-ter-ist]. Noun On a daily simple interest loan, a borrower agrees to principal (the money originally borrowed) plus interest (the amount a lender charges to borrow) as it accrues from payment to payment. Interest accrues each day on the current unpaid principal amount. Borrowers owe less interest and pay more towards principal when they make their loan payments on time. If payments are late, missed or irregular, however, less of the payment is applied to principal and more is applied to interest.

That’s a formal definition of daily simple interest (DSI), but for anyone new to loans, interest and repayments, it may not seem as “simple” as it sounds. But have no worry, we’re going to explain it. When we’re done, you should have a better understanding of:

- How daily simple interest works

- The sensibility of paying on time

- How to avoid paying more for a loan than necessary

What is a daily simple interest loan?

When it comes to taking out a loan, it’s commonly understood you’ll need to pay it back with interest. That’s why the total amount you pay back is higher than the original loan figure.

For example, let’s say you needed to borrow $3,000 for some unexpected auto repairs.

On a 36-month, $3,000 loan at 25% interest with no extra fees, you might be asked to make monthly payments of $119.28.1 If all your payments are in full and on time, using the daily simple interest method, you’d pay back a total of $4,294.08.

But while many people initially assume the interest rate is calculated on a monthly or yearly basis, a DSI loan works differently.

As the name suggests, a daily simple interest loan means that interest is accruing every day. However, since that interest is only calculated on the current unpaid principal, your lender splits your payment amount between the interest owed and a portion of the principal balance. Every time you make a monthly payment by the due date, the interest charges will be lower with your next payment.

So, how is DSI calculated?

Everyone knows that paying on time is important, but did you know that the timing of your payment affects how that balance decreases?

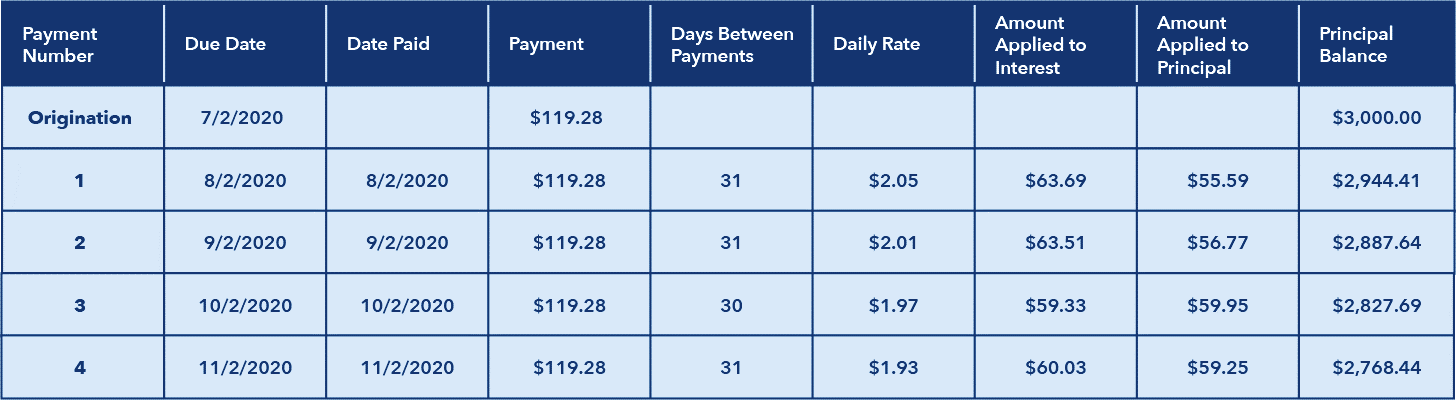

Using our example of a 36-month, $3,000 loan with a 25% interest rate, that would mean the interest would begin at a little over $2.05 per day.

$3,000 x (25% interest/365 days) = $2.0547

After 31 days, your loan will accrue $63.69 in interest.

$2.0547 x 31 = $63.69

When that first monthly payment of $119.28 comes due, $63.69 of it goes toward the interest and the remaining $55.59 will be applied to the $3,000 principal balance.

New principal balance: $2,944.41

This is one of the primary advantages of a daily simple interest loan – when you make payments on time, the amount you owe goes down, and therefore the amount of interest you’re charged the next month will be lower.

So, if the following month also has 31 days, the daily interest will be based on the new balance.

$2,944.41 x (25% interest/365) = $2.0167 daily interest $2.0167 x 31 days = $62.51 monthly interest New principal balance: $2,887.64

With each on-time payment, the principal balance will continue to decrease:

KEY TAKEAWAY: As long as you continue to make your monthly payments in full and on time, this pattern will continue until the loan is paid back in full.

This works because:

- Your payments will cover the interest due and reduce the principal each month

- Your interest charges will decrease as the principal balance goes down

- You will avoid late fees

- Your loan will be paid off as scheduled

What if I make an additional, one-time large payment on top of my monthly payment?

Let’s say you found a cheaper way of repairing your car and instead of needing the full $3,000, you only use $1,500. In that situation, you may choose to spend the leftover money on something else, or you could pay it back to the lender.

Returning to our example, if you paid the lender the first repayment of $119.28 but then returned the extra $1,500, that would bring the principal balance down to $1,444.41. (Remember, $55.59 of that first payment already went to the principal.)

$3,000 – ($55.59 + $1,500) = $1,444.41

This extra payment effectively cuts your remaining principal in half and means you are now accruing less daily simple interest.

The fact that you only accrue interest on your current principal balance is one of the main advantages of a daily simple interest loan, but it only works in your favor if you pay your loan payments on time each month.

What if I miss a payment?

The flipside is that if you miss a payment, you will accrue more interest. (In addition, depending on the terms of your loan agreement, your lender may charge you a late fee.)

Let’s say you skipped that first monthly payment of $119.28 on the $3,000 loan.

Because you missed the first payment, interest keeps adding up, and in the second month you would owe $127.38 in interest ($2.0547 x 62 days)!

In this scenario, as highlighted below, although you’ve caught up, the fact you skipped a month cost you an extra $1.18 of interest by not paying when it was originally due. And if you missed further payments the costs would go up even more.

Let’s see how that new calculation works out:

Loan balance: $3,000

- unpaid accrued interest (for two months): $127.38

- catch-up payment (months 1+2): $238.56

New principal balance: $2,888.82

What about late payments?

With daily simple interest loans, late payments also mean you pay more interest. Even if your late payment was accepted within a grace period and no late fees were incurred, every day that you’re late means another day for daily simple interest to accrue.

Let’s say the payment for the first month of your $3,000 loan for auto repairs was due on the 2nd of February, but you paid it on 17th of February – 15 days late. The interest charge for those 15 days plus the first 31 days you owed in interest would be $94.52.

Because your payment arrived late, instead of reducing your principal balance by $55.59 in the first month you would only reduce it by $24.76, since more of the payment went to that extra interest. So, your principal balance is now at $2,975.24 instead of the $2,944.41 it could have been, because you paid late.

It may not sound like a lot of money now, but if you’re late or miss payments on a regular basis you’ll accrue more interest, and it will take you longer to pay off the loan.

When you make late payments, the following may happen:

- Your standard payment may not be enough to satisfy the interest that is due

- Unpaid interest will continue to add up

- There could be less principal reduction

- You may be charged late fees

The consequences of late or missed payments

As outlined above, making payments late or missing them entirely will result in you having to pay more interest, and it might mean your daily simple interest loan takes you longer to pay off.

Your lender may also charge late fees for late payments, which would add to the overall cost of your loan.

A recap on daily simple interest

Here are the things worth remembering about daily simple interest:

- Interest accrues daily

- You’re charged interest on your unpaid principal balance

- When you make a payment on time, you pay the interest accrued in the previous month first, with the remaining payment amount going toward the principal

- By paying more than your scheduled payment or paying early, you can potentially reduce the amount of payments you have to make and lower the amount of interest you pay

- If you miss a payment or pay late, you’ll end up paying more interest

- Your lender may charge you late fees if you pay late or miss a payment

- Even if a late payment is accepted within a grace period and you are not charged a late fee, every day you’re late means another day for daily simple interest to accrue

- Late or missed payments can result in negative credit reporting

In summary, daily simple interest loans are ones where interest accrues daily on the unpaid principal balance. As the principal balance is reduced, the interest charges go down because less interest accrues on a smaller principal balance. While it may not be easy to understand at first, one thing is clear: If you make your loan payments on time, you will avoid paying additional interest charges and will pay your loan off as scheduled.

1. Note your lender may add fees and processing charges. These can vary and haven’t been factored in the examples in this article, which are for instructional purposes only.

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.