What Is a Title Loan and How Does It Work?

Summary

Title loans, also known as car title loans, are a risky option when you need money. Learn more from OneMain about the dangers of title loans.

In this article:

When you’re short on cash and facing an emergency, it can be tempting to accept any financial relief you can find.

But if you’re considering a title loan, it’s important to learn what it is and what it’s not and understand the potential dangers of this risky loan option. The following information can help you make an informed decision.

What is a title loan?

A title loan, also known as a car title loan, pink-slip loan, fast auto loan, or title pawn, is a loan that uses your car title as collateral. It is a short-term, high interest loan, typically for a small amount of money ($500 to $1,000) that has a high annual percentage rate (APR) – often upwards of 300% – making it difficult to pay back.1

By definition, title loans require that lenders hold your vehicle's title as a repayment guarantee. The financial term for this is collateral. You might already be familiar with this financial term since secured personal loans also use collateral. However, secured loans from trusted lenders, who give you 2 to 5 years to repay and implement APR limits of no more than 35.99%, offer much better terms if you qualify.

Why are title loans a poor choice? Because, much like a payday loan, title loans are a form of predatory lending.3 This type of lending often features unclear terms and targets those with those with low income and low credit.

Be on the alert for predatory title lenders. Predatory lenders convince borrowers to take out a loan with unfair terms, including high fees, high interest and short repayment terms.4 They may also pressure you or employ other tactics used by untrustworthy lenders.

How do title loans work?

In exchange for a title loan, you give the lender the title to your car, truck or motorcycle. Lenders typically require borrowers to own their vehicle outright, but some will still provide funds if you’ve paid off most of your car loan.

Repayment terms are short, usually 15 to 30 days. If you fail to pay off the loan in time, you risk high fees, losing your vehicle.

How much can you borrow with a title loan?

A title loan is typically for a relatively small amount of money, often 25% to 50% of a vehicle’s value. For example, if your car is worth $4,000, your title loan could start at roughly $1,000.

How long do you have to pay back a title loan?

Most title loans are due in 30 days, although some can be due in as few as 15 days. While less common, some title loans require borrowers to pay lenders back in installments, usually within three to six months.

These loan terms differ greatly from what trusted lenders like OneMain Financial offer, which typically gives customers two to five years to repay a loan.

What are the risks and downsides of a title loan?

Like all predatory lending practices, title loans can be expensive, consuming 50% of the average borrower’s gross monthly income. According to the Pew Charitable Trusts, borrowers pay an average of $1,200 in fees for a title loan of just $1,0005.

If you're considering taking out a car title loan, it's important to be aware of the potential risks involved. While title loans can offer a quick and easy way to access cash, they also come with several catches that you should be aware of before you sign on the dotted line.

One of the biggest downsides of taking out a car title loan is the possibility of losing your vehicle if you can't repay the loan. If you default on your loan, the lender may have the right to repossess your car. This means you could end up without a vehicle and a way to get to work or school.

Another drawback to be aware of is the high interest rates typically associated with title loans. These high interest rates c an make it very difficult to repay your loan, and you may end up paying back much more than you originally borrowed. With APRs typically at 300%, title loans are expensive and can put you in a cycle of debt that places you in a worse position than you were in the first place.

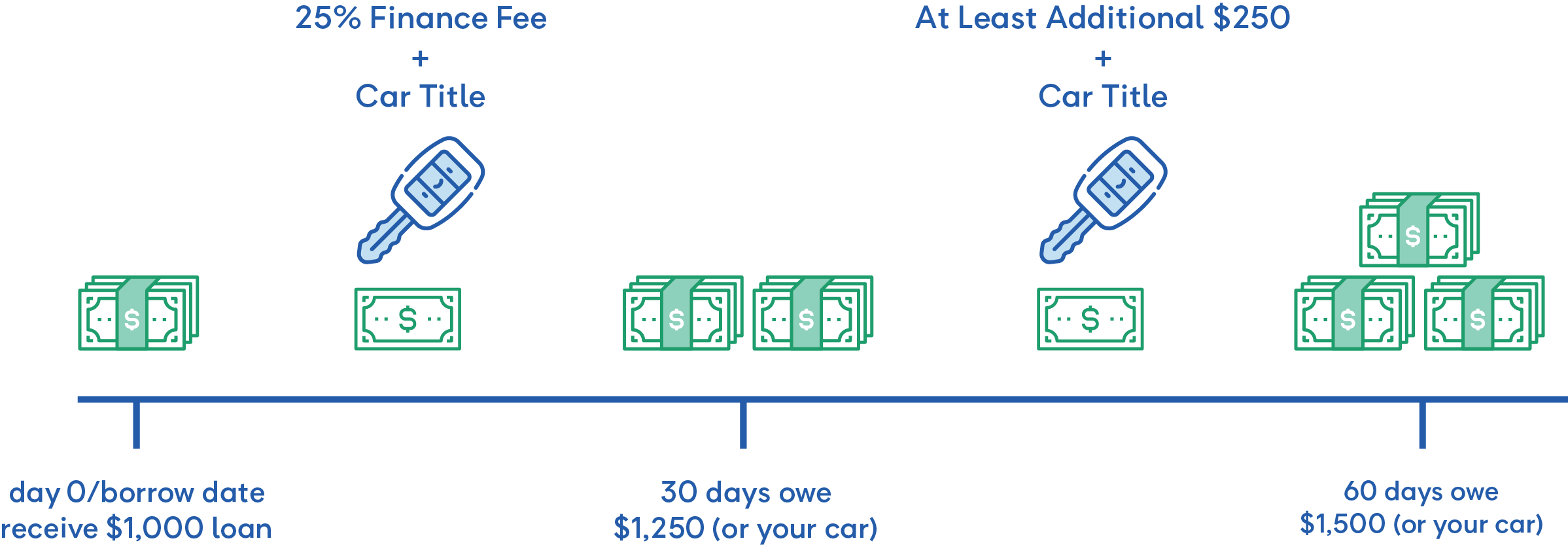

For example, if the finance fee for a title loan is 25%, you would have to pay $250 to borrow $1,000. If you’re unable to pay the loan in full after 30 days, you would “roll over” the loan to the next month and pay an additional $250. In just two months, your total fees are now up to $500 – 50% of your total loan amount.

Finally, car title loans are typically only available for a short period, so you'll need to repay the loan very quickly. This can be difficult if you're already struggling to make ends meet.

Title Loan Alternatives

While title loans can provide quick cash, as mentioned, they come with significant risks and high costs. If you're exploring alternatives to title loans, consider these options.

- Personal Loans: Personal loans from banks, credit unions, or online lenders often have lower interest rates and more favorable terms than title loans. Your monthly payment, for example, will remain consistent, assuming all your payments are made on time. Please keep in mind that your credit history plays a role in determining eligibility and rates.

- Credit Card Cash Advance: If you have a credit card, you can use it for a cash advance. While the interest rates are still high and may keep adding up, they may also be more favorable than title loan rates.

- Peer-to-Peer Lending: Online platforms connect borrowers with individual investors willing to lend money. Rates can be competitive, and the application process is usually straightforward.

- Emergency Assistance Programs: Some local organizations and charities offer financial assistance to individuals facing emergencies. These programs can help with immediate needs without the high costs of title loans.

- Negotiate with Creditors: If your financial struggles are due to existing debts, consider negotiating with creditors to lower interest rates or arrange more manageable payment plans.

- Borrow from Family or Friends: While this option requires caution and clear terms, borrowing from loved ones can be a cost-effective and less risky way to get financial help.

- Employer-Based Loans: Some employers offer salary advances or loans to their employees in times of need. Check with your employer's HR department for available options.

- Building an Emergency Fund: Consider establishing an emergency fund over time to have a financial cushion for unexpected expenses. This proactive approach can help you avoid the need for high-cost loans.

Should I get a title loan?

Title loans are high-risk and costly, often making them a last resort. Before committing to a title loan, it's wise to consider your financial situation carefully and explore other borrowing options such as loans from reputable lenders with reasonable terms. Losing your vehicle is a significant risk with title loans. Making an informed decision can help you avoid unnecessary debt and protect your assets.

1.https://www.creditkarma.com/personal-loans/i/how-do-title-loans-work

2. https://www.consumer.ftc.gov/articles/what-know-about-payday-and-car-title-loans

3. https://www.consumeradvocates.org/for-consumers/predatory-lending

4. https://www.nerdwallet.com/article/loans/personal-loans/what-is-predatory-lending

5. https://www.pewtrusts.org/~/media/assets/2015/03/autotitleloansreport.pdf

This article has been updated from 2020 and from 2022. Jessica Leshnoff and Melina Duffett contributed.

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.