Home Equity Loan vs. Home Improvement Loan

Summary

Learn the differences between Home Improvement Loan vs. Home Equity Loan and compare them to see which type of loan terms is best for you.

In this article:

- What is the difference between a home equity loan and home improvement loan?

- How do home equity loans work?

- How to calculate your home’s equity

- How do home improvement loans work?

- Pros and cons of home improvement loans vs. home equity loans

- Does OneMain offer home improvement loans?

- Home sweet home loan

Dreaming up a major home reno? Or just checking a couple quick fixes off your list? If you need help making it happen, you have options. A home equity loan or home improvement loan can give you the power to invest in the place you call home. Which type of loan is right for you depends on the scope of your improvements and your specific financial situation. Learn about the differences between home equity loans and home improvement loans so you can start your project.

What is the difference between a home equity loan and home improvement loan?

A home equity loan is typically a larger loan you can use to borrow against your home’s value and the portion of it you own (equity). A home improvement loan is generally a smaller loan that’s based on your personal borrowing power. Home equity loans are always secured by your home, while home improvement loans can be secured or unsecured. Technically, the proceeds of either type of loan can be used for any purchase, but many people choose to use the money to invest in their homes.

Here are some basics of home equity loans vs. home improvement loans

Secured vs. unsecured. A home equity loan is secured by your home, which is used as collateral. That means if you fail to make loan payments, the lender can take your home as repayment through foreclosure. Some home improvement loans require collateral, but many don’t. If a home improvement loan isn’t secured, failure to repay could result in a hit to your credit score.

Interest rates. Home equity loans tend to come with lower interest rates than home improvement personal loans because they are secured by your home. A loan secured with such a large asset is often considered less risky by lenders.1

Amount and length of loan. Home equity loans are often larger than home improvement personal loans and can have longer pay-off periods. Some people refer to home equity loans as a “second mortgage,” in part because they have similar loan repayment terms to standard mortgages, from 5 to 30 years.2 Home improvement loans are typically available with around 2- to 7-year repayment periods.3

Approval process. It’s generally a more complicated, longer process to get approved for a home equity loan versus a home improvement loan, mostly because home equity loans tend to be larger. You can apply for a home improvement loan with a wide variety of lenders, including online lenders that offer a quick, simple application process.

How do home equity loans work?

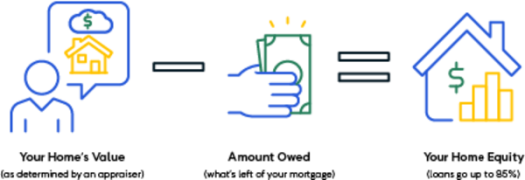

Home equity loans require that you have some equity in your home. Equity is simply the difference between what you owe on your mortgage and the current value of your home. Since you own that portion of your home, you may be able to borrow against it. (See how to calculate your home’s equity below.) The less equity you have, the smaller the loan will be. Lenders generally issue home equity loans for up to 85% of your total equity.4

You can apply for a home equity loan with your current mortgage provider or pick from a variety of other banks, credit unions and financial institutions. Once you’re approved for the loan, you’ll receive a lump sum and repay it over a set period of time with a fixed interest rate and regular monthly payments. In short, home equity loans work much the same way as primary mortgage loans. Like home improvement personal loans, you can use a home equity loan however you want. Many borrowers use home equity loans for home improvements simply because it makes sense to borrow against your home to improve it and raise its value.

How to calculate your home’s equity

For example, say you bought your home for $250,000, and according to an appraisal (something you’ll likely need for a home equity loan), your home is now worth $300,000. If you’ve already paid $25,000 of your mortgage and made a $50,000 down payment, you have $125,000 in equity. Using your home as collateral, you can now borrow against that equity. It’s important to note that lenders typically limit these loans to 85% of your home’s equity.

How do home improvement loans work?

Home improvement loans are the same as other personal loans: installment loans that offer a lump sum of money you then pay off monthly with fixed payments and at a fixed interest rate. They tend to be smaller than home equity loans, usually from $1,000 to $50,000, though some lenders may issue loans up to $100,000.5 Some home improvement personal loan lenders may allow access to funds as quickly as a day or two.6

Pros and cons of home improvement loans vs. home equity loans

When considering home improvement versus home equity loans, keep in mind that they both have pros and cons. Make your choice depending on what you’d like out of your loan and how you plan to use the money. Are you finally getting around to fixing up your fixer-upper? You might want to get a home equity loan for a full renovation. Or are you looking to do some quick fixes before hosting the holidays? A home improvement personal loan might be faster and easier.

Home improvement loans

- Typically, quick access to money

- Simple application process

- May not require collateral

- Fixed monthly payments

- Fixed interest rates

- Good for small projects

Home equity loans

- Large loan amounts available

- Lower interest rates than personal loans

- Fixed monthly payments

- Fixed interest rates

- Good for large renovations

Does OneMain offer home improvement loans?

Yes. Using a personal loan to fund your next home renovation or remodeling project could make your dreams a reality. You can make payments over time, but start working on your kitchen remodel or roof replacement now. Our loan experts will work with you one-on-one to help you determine if a personal loan for home improvement best suits your financial needs. If you're approved, you could get your money within hours of loan closing by using your bank-issued debit card.7

See if you prequalify for a OneMain personal loan for home improvement

Home sweet home loan

We all know a house is more than four walls and a roof; it’s your home and an investment in your future. Making home improvements can be well worth the time and money if you’re thoughtful about your choices and do your research. When weighing a home equity loan versus a home improvement loan, keep in mind that one isn’t better than the other. However, one might be a better fit for your financial situation and your home improvement goals. Good luck, and happy home loan hunting!

1. "Personal Loans vs. Home Equity Loans: Which Is Right For You?." 22 Jul. 2022, https://www.bankrate.com/loans/personal-loans/personal-loans-vs-home-equity-loans/. Accessed 25 Oct. 2022

2. "Home Equity Loan vs. HELOC: What's the Difference? - Investopedia." https://www.investopedia.com/mortgage/heloc/home-equity-vs-heloc/. Accessed 24 Oct. 2022.

3. "Best Home Improvement Loan Rates in October 2022 - Bankrate." https://www.bankrate.com/loans/home-improvement/rates/. Accessed 25 Oct. 2022.

4. "What's the Most You Can Borrow With a Home Equity Loan?." https://www.investopedia.com/home-equity-loan-maximum-5323470. Accessed 26 Oct. 2022.

5. "Best Home Improvement Loans of October 2022 - Investopedia." https://www.investopedia.com/articles/personal-finance/121216/home-improvement-loans-what-are-your-best-options.asp. Accessed 24 Oct. 2022.

6. "Best Personal Loans for Home Improvement of 2022 - Experian." 16 Sep. 2022, https://www.experian.com/blogs/ask-experian/best-personal-loans-for-home-improvement/. Accessed 28 Nov. 2022.

7. Funding Options; Availability of Funds: Loan proceeds may be disbursed by check or electronically deposited to the borrower’s bank account through the Automated Clearing House (ACH) or debit card (SpeedFunds) networks. ACH funds are available approximately 1 to 2 business days after the loan closing date. Funds through SpeedFunds can be accessed on the loan closing date by using a bank-issued debit card.

This article is for general education and informational purposes, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any purpose and is not intended to be and does not constitute financial, legal, tax, or any other advice. Parties (other than sponsored partners of OneMain Financial (OMF)) referenced in the article are not sponsors of, do not endorse, and are not otherwise affiliated with OMF.